Fine Wine & Spirits

Vinovest Capital Whiskey Fund SPV

Offering Details

Minimum investment size:

Investor Type:

Accredited Investors

Launch Date:

April 26th, 2024

Fees:

0.25% quarterly on capital account balance*

SPV Management Fee: 2%

Offering period:

The Fund’s investment period shall begin on the Initial Closing Date and shall end on the last day of the 12th month following of the Final Closing Date. This is subject to extension.

*Please see the offering documents for all fees and expenses. Any projections are based on historical data and should not be seen as guarantees of future performance. Market conditions vary, and past performance does not guarantee future results.”

About the Investment

Vinovest Capital Whiskey Fund

The Vinovest Capital Whiskey Fund offers accredited investors exposure to whiskey, which Knight Frank reported in 2020 as one of the best-performing collectibles of the 2010s.

Alternative assets traditionally have little correlation with stock performances, and some have seen consistent appreciation, even in an inflationary environment. This may help shield investors’ portfolios from public market volatility.

- High barriers to entry

- Limited Transparency

- Regulatory red tape

- High costs for regulated storage and insurance

- Limited knowledge of how to begin investing in the asset class

Whiskey Fund Strategy

The Vinovest Capital Whiskey Fund’s strategy seeks to leverage the market trend of contract distillers selling to whiskey brands.

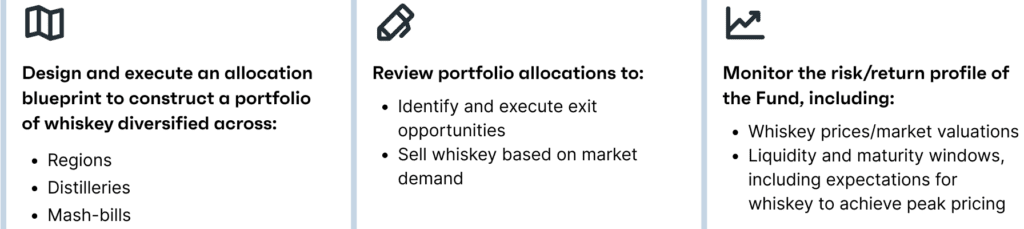

The team at Vinovest strives to actively:

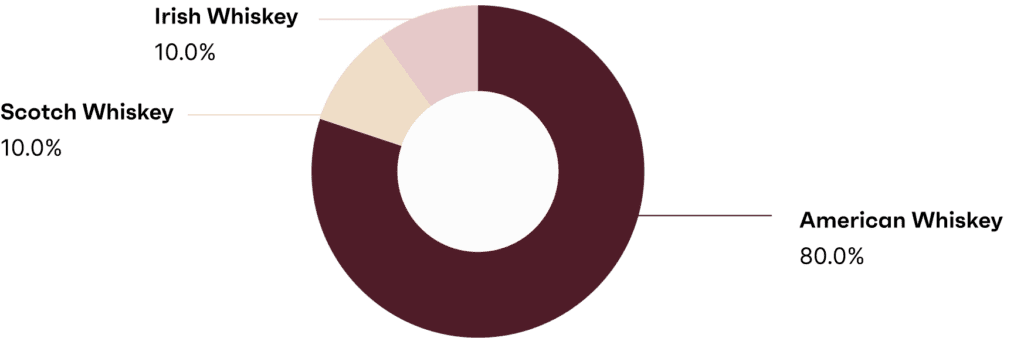

The Vinovest team anticipates a portfolio for the Capital Whiskey Fund to be heavily focused on American Whiskey, with diversification to Scotch Whiskey strategically determined as a minority, yet relevant allocation.

Please note that any references to “liquidity” within these offering documents do not pertain to the liquidity of the private securities offered by the fund.

Newly distilled whiskey ups the potential for returns and wealth preservation

When considered as a tangible good governed by the laws of supply and demand, rare whiskey makes sense as an investment worthy of consideration.

The overall whiskey market is on pace to grow to more than $127 billion by 2028. And it packs the potential to help investors realize long-term gains due to the increasing demand for rare and limited-edition bottles.

Scotch Whiskey

Examples provided are for illustration only and do not represent fund holdings. Refer to official documents for accurate information.

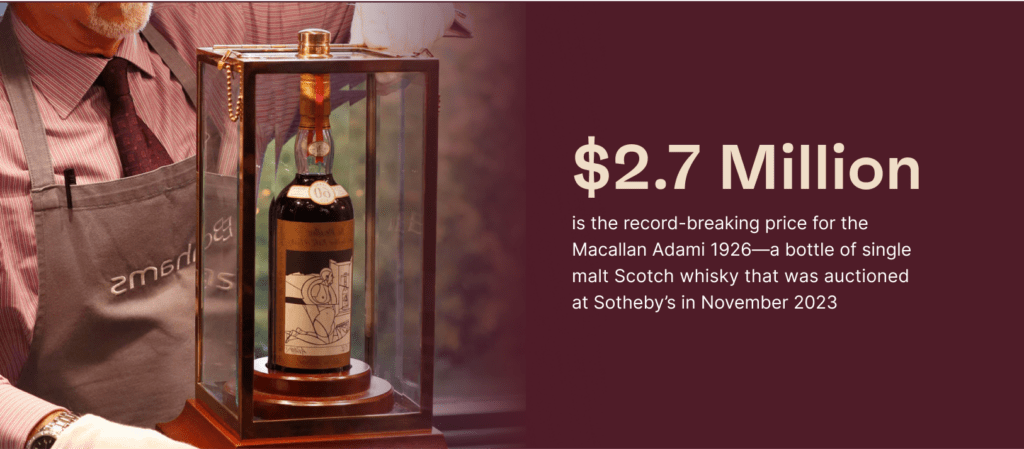

Nearly 90% of Scotch whiskies are bottled in blends and single-malt expressions, and they’re in great demand. Take, for example, the Macallan Adami 1926. This bottle of single malt Scotch whisky was auctioned at Sotheby’s in November 2023 for a record-breaking price of $2.7 million.

Rare bottles notwithstanding, the market for Scotch alone is large, and continuing to grow. In fact, 43 bottles are exported every second to over 160 markets across all corners of the globe. That’s over 1.35 billion bottles of Scotch every year, which, for perspective, would wrap around the Earth 11 times if we laid them out end to end.

And Scotch only scratches the surface of the world of whiskey.

American Whiskey

American whiskeys, which are also included in Vinovest’s Capital Whiskey Fund, span a range of brands like Bulleit and Blanton’s to Booker’s and beyond.

American whiskey has seen over a decade of market share gains in the global whiskey market, according to the Distilled Spirits Council, and it is expected to see continued growth. Exports to the EU were up nearly 64% in 2023 compared to 2022, and they increased by 29% in 2022 compared to 2021 (reaching $566 million in 2022).

Tangibility & Regulatory Tailwinds

Whiskey is a tangible asset with a finite supply. As international demand increases, market participants and distillers are unable to keep up as whiskey requires years of aging before it is sold for consumption.

Additionally, all bourbon is legally required to be aged in new, charred oak barrels. This means that bourbon producers cannot reuse barrels, presenting a rarely specific supply limitation that sees regular barrel shortages. The unique pressure on the supply chain for production helps keep prices for whisky up.

Expert Partners

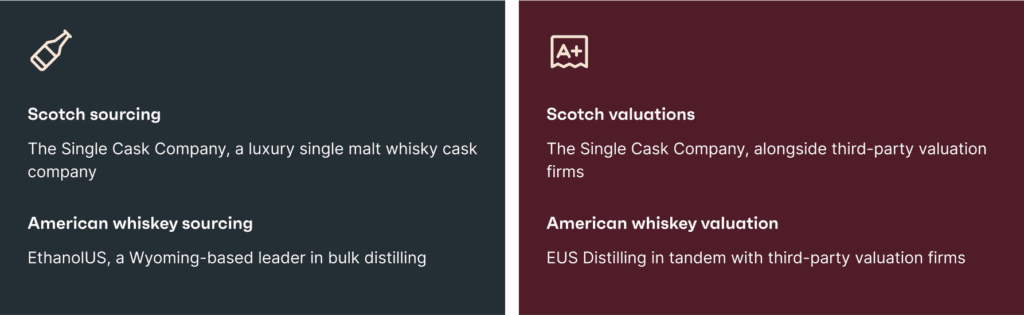

Vinovest partners with trusted industry leaders to source and price each premium whiskey in the Vinovest Capital Whiskey Fund:

Exit Opportunities

The Vinovest Capital Whiskey Fund targets standard timelines of two, three and four years before selling into the active market for barrel whiskey to whiskey brands and distilleries, spirits brokers, and into the rapidly growing international markets.

About Alto Capital, SPV Fund Manager

Alto Capital is a forward-thinking exempt reporting advisor that prides itself on finding unique opportunities within alternative assets. They aim to bridge the gap between private equity, venture capital, and other alternative assets, generally with higher minimum investments that might be closed to individual investors. Alto Capital serves as the administrator of the SPV and is an affiliate of Alto Securities, LLC; both entities are under common ownership.

Eric Satz

As Founder of Alto, Eric connects the dots that are hard to see, thanks to his years of experience across financial services and entrepreneurship. He kicked off his career as an investment banker for Donaldson, Lufkin & Jenrette, and Credit Suisse First Boston. He also co-founded Currenex, and Tennessee Community Ventures, a venture capital firm.

Scott Harrigan

Scott is a global financial software services specialist with years of experience in software design and implementation. Scott spent a good deal of his career in the public markets and then moved to Carta, where he was first exposed to private markets and how differently they operate. He then had the opportunity to work for Securitize, where he learned about blockchain and the digital asset security industry. Scott is also a board member for Cheqly, a full-stack neobank for startups.

Meet Vinovest

At a glance

Reasons to consider investing in an inspiring startup modernizing the world of fine wine and rare spirits investing

- Stable Growth

Whiskey was the best-performing asset between 2010 and 2020 and has seen average annual returns of 12%. Some investors in Europe and Asia have even seen average returns of 31.46% over the last five years.

- Proven Performance

Vinovest’s experts actively manage investors’ portfolios, tracking each whiskey’s maturity date to know when to buy, hold, and sell at peak value. The team has been at it since 2019 with trusted partners working in tandem across the globe.

- Trusted Partners

Vinovest sources Scotch with The SingleCask Company and American whiskey with several contract distillers, including EthanolUS. It also works with EUS Distilling to handle American whiskey valuations and the Single Cask Company for Scotch, as well as other industry standard partners such as insurance providers for updated market pricing.

- Secure Storage

All assets are insured and matured in secure, bonded and federally regulated warehouse facilities.

- Curated Collections

Vinovest has global connections with producers and merchants around the world, giving investors access to a carefully curated collection of whiskey below retail prices.

Meet the team

Anthony Zhang, CEO, Co-Founder

Anthony is the co-founder and CEO of Vinovest, a platform democratizing access to investing in wine and whiskey as an alternative asset class.

Prior to launching Vinovest, Anthony founded and sold two companies, EnvoyNow and KnowYourVC. EnvoyNow received funding from Shark Tank’s Mark Cuban, and famed TV producer Mark Burnett. His work scaling the business to global markets and guiding it through acquisition by Joyride, a subsidiary of WalMart, earned him the prestigious Thiel Fellowship award, for which he was awarded $100k in funding from Peter Thiel’s Thiel Foundation. His second company, KnowYourVC, a platform for vetted reviews on angel investors and venture capitalists, was acquired by RateMyInvestor. He remains an active board member.

Anthony has also served as the head of marketing and business development at Blockfolio, a cryptocurrency portfolio management app, and helped lead teams to scale the user base to 10+ million users before it was acquired for $150M.

Recognized for his achievement as an entrepreneur, Anthony has earned the Interact Fellowship award and landed on the Los Angeles Business Journal’s “20 In Their 20s” List. He is also a mentor at WineUnify, a nonprofit sponsoring funding and career.

Hunter Robillard, Head of Whiskey

Hunter started his career in the spirits industry at Custom Spirits LLC, his family’s company, eventually becoming a sales manager & co-owner at the company. Custom Spirits is the creator of the US’s first registered “flavored whiskey”; Cabin Fever Maple Whiskey. Hunter’s first role at the company was in production & product development. It was this early exposure to the whiskey making process that led to his advanced knowledge of distilling & blending techniques.

Over time Hunter moved into a specialized sales role at Custom Spirits and was responsible for leading product launches in new markets. During his tenure, he helped the company’s flagship brand, Cabin Fever, expand from 3 states to 18 states. The successful early-stage growth of Custom Spirits flagship brands led to it being acquired by Diageo, the world’s largest spirits company. After the acquisition Hunter assisted Diageo with the national rollout of various Custom Spirits brands to all 50 states and Canada. After leaving Custom Spirits & Diageo, Hunter worked at Deutsche Beverage Technology, an equipment manufacturer for the beverage industry. He helped some of the nation’s largest breweries, distilleries, & wineries with their manufacturing equipment needs.

Hunter joined the Vinovest team in May of 2020 and has not looked back since. His current role focuses on building supplier relationships, overseeing whiskey portfolio buildouts, and leveraging industry relationships to build out multiple liquidity channels. His role blends his passion for the spirits industry with alternative investing.

Ryan La Valle, Senior Portfolio Manager

Ryan is a Senior Portfolio Manager at Vinovest. Before assuming his role there, Ryan’s contributions left a significant impact on MetLife Investment Management’s Institutional Client Group and S&P Dow Jones’ Sales Strategy & Client Service Teams. Accumulating a decade of experience within the global and domestic Investment and Financial Services sector, Ryan’s professional journey underscores his unwavering dedication and comprehensive grasp of the intricate financial landscape.

Ryan’s qualifications include the FINRA Series 7 (Registered Representative) & Series 63 (Uniform Securities Agent). Ryan graduated with distinction from Seton Hall University, securing a Bachelor’s degree in International Relations & Economics before going on to complete an MBA program at Penn State University.

Ryan’s fervor for wine led to his completion of the esteemed WSET Level 2 & Level 3 awards in Wine & Spirits / Wine, a testament to his pursuit of continued knowledge in the wine and spirit industry.

Simplified access to whiskey

Vinovest makes investing in rare whiskey simple and more accessible for the average investor. Its digitally native business model consolidates supply, considers industry trends, and provides exposure to various factors of the asset class. While simplifying the process, all investments come with risks. Investors should conduct their own due diligence to ensure it is the right investment for them.

While no investment’s performance can be guaranteed, we believe that the longer-term horizons of alternative assets can align nicely with the future-looking strategy adopted for retirement funds.

Now, for a minimum investment of $25,000 into the Alto Capital Vinovest Capital Whiskey Fund SPV, individual accredited investors can embrace exposure to the multi-billion dollar market of whiskey and adopt a duration-matching mindset in an investment into alternatives.

Documents

Citations

*Please be aware that Alto Capital SPV charges a one time management fee of 2%. This fee is charged for the management and operation of the SPV and is separate from the fees associated with the underlying investment opportunity. Understanding that this management fee is an additional cost that will affect the overall return on your investment is crucial. Furthermore, the underlying fund also charges separate fees. These fees differ from the SPV’s annual management fee and may impact your investment returns. To ensure you have a comprehensive understanding of all fees and charges that apply to your investment, we strongly encourage you to review the offering documents thoroughly. These documents provide detailed information on all fees, charges, and the terms of your investment. Additionally, our team is here to help clarify any questions or concerns you may have regarding the fee structure or any other aspect of your investment.

Get in touch

We’re here to help.

*Offer available to Accredited Investors only

Alto Content

Learn more from selections of our best resources on a range of issuers, asset classes and investment opportunities.