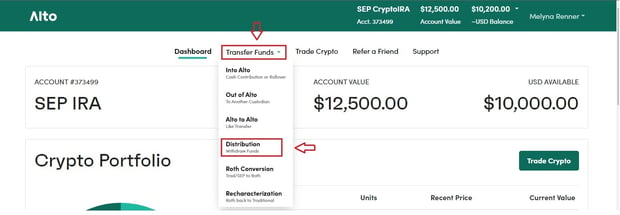

- Select Transfer Funds at the top of the page

- Select Distribution from the drop-down menu

- Enter the amount

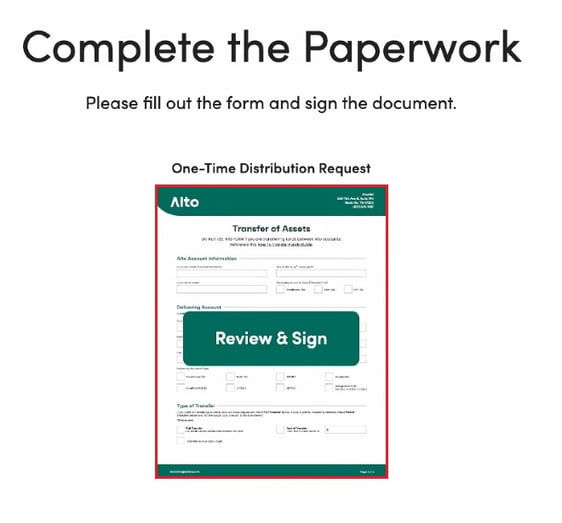

- E-sign your name exactly as it displays

- Click Review & Sign to enter the distribution form

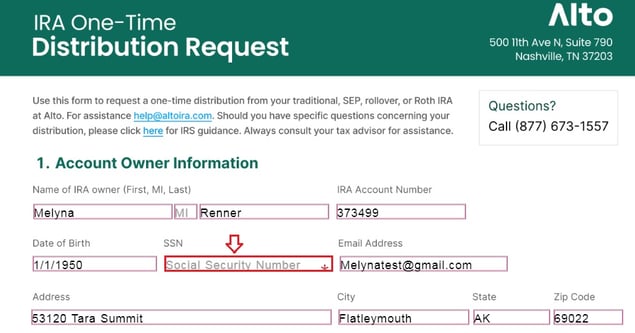

- Enter your SSN

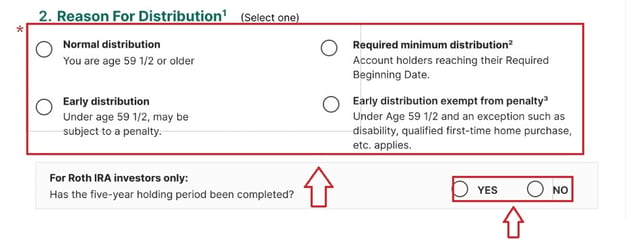

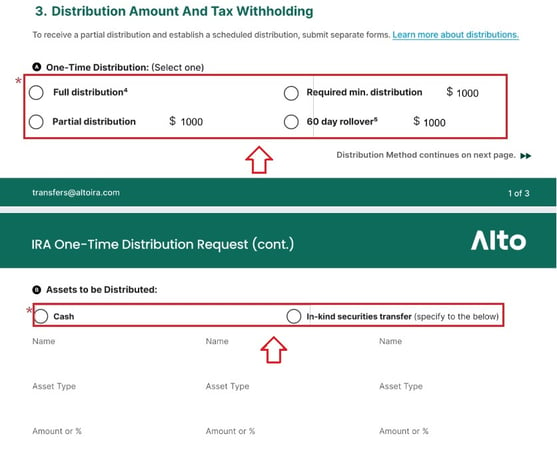

- For the remainder of the form, only one selection should be made for each question

Note: In-kind distributions do not apply to crypto assets. Cryptocurrencies must be sold and distributed as cash.

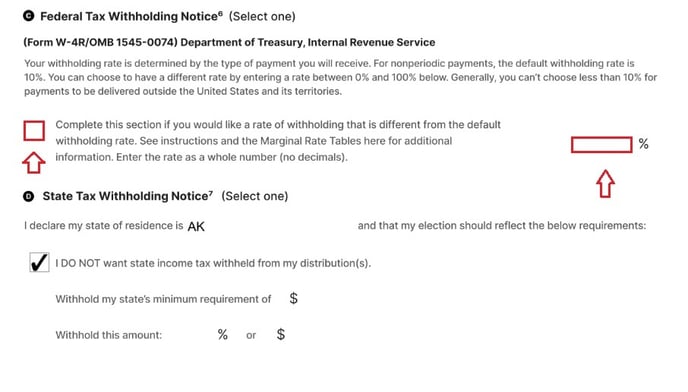

- Elect Federal tax withholding (please fill in a range from 0% to 100%)

- Note: If no election is made the default tax withholding rate is 10%. AltoIRA does not withhold state taxes at this time.

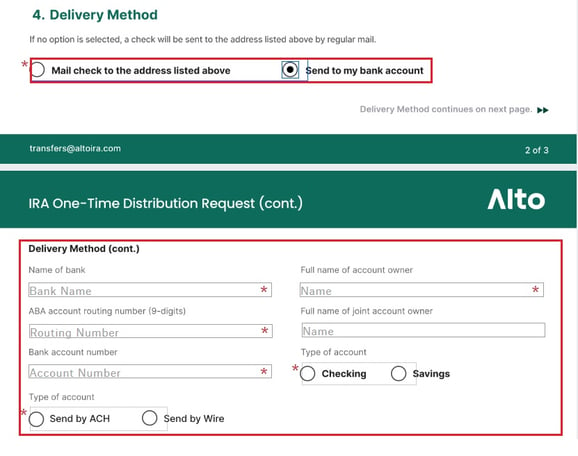

- Select delivery method

- Once the document has been signed and submitted, your request will be processed as soon as possible.

If you have any questions, please reach out to us:

- Phone: 877-673-1557

- Email: transfers@altoira.com

- Contact Us Form