As more investors look beyond traditional investments like stocks and bonds, many are looking to buy crypto in a way that aligns with long-term growth.

A crypto IRA combines the high potential of digital assets with the tax benefits of retirement savings.

The upside is clear: Crypto can be traded or held inside an IRA without paying immediate capital gains tax. Over time, this can compound into significant savings. But investing in cryptocurrency for retirement isn’t without risk—it requires knowledge, discipline and compliance with IRS rules.

This guide explains how to buy crypto in an IRA, the account types available, tax implications, risks and step-by-step instructions

Understanding cryptocurrency in retirement accounts

A traditional IRA portfolio is usually made up of stocks, bonds and mutual funds. With a self-directed structure, however, investors can potentially add alternative assets such as:

- Real estate

- Precious metals

- Private equity

- Cryptocurrency

Purchasing crypto in a retirement account works differently than in a typical brokerage account:

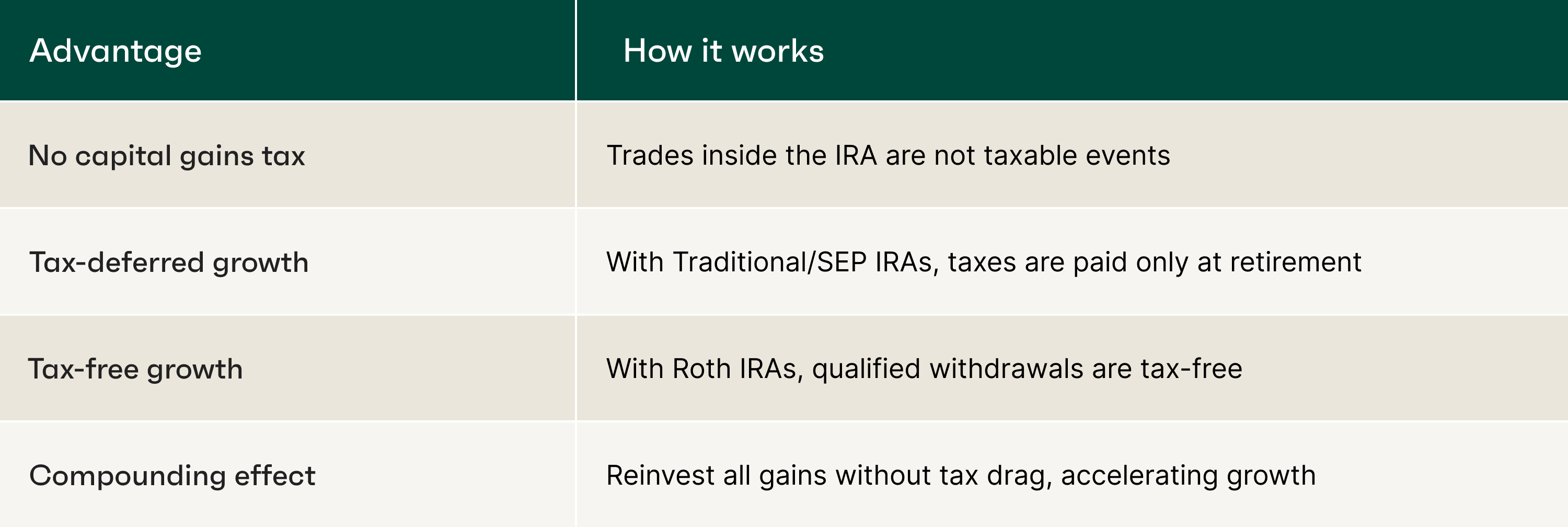

- No capital gains tax on trades made inside the IRA.

- Growth can be tax-deferred (Traditional/SEP IRA) or tax-free (Roth IRA).

- All transactions must flow through an approved custodian for compliance.

This structure makes crypto IRAs an attractive option for long-term investors seeking diversification.

Overview of IRAs and self-directed IRA options

Standard IRAs at brokerages typically don’t allow direct crypto purchases. To buy crypto in an IRA, you need a self-directed IRA (SDIRA).

- Traditional IRAs: Limited to conventional assets.

- SDIRAs: Broader choices that can include crypto, real estate and other alternatives.

A custodian manages the account and ensures IRS compliance. While custodians don’t give financial advice, they process transactions, hold assets securely and handle reporting.

How crypto fits into modern retirement planning

As cryptocurrency continues to gain wider acceptance as a legitimate asset class, it can present certain upsides in building a well-rounded, resilient retirement plan:

- Act as a diversifier, since it doesn’t always move with stocks or bonds.

- Offer the potential for strong returns, with historical examples of significant gains. Past performance is not indicative of future results.

- Serve as a possible inflation hedge due to limited supply.

But crypto also carries high volatility. For retirement planning, that means:

- Younger investors with decades ahead may afford a larger allocation.

- Near-retirees may prefer minimal exposure to reduce risk.

Balance is key: Investors should ensure crypto is a complement, not the core, of their retirement plans.

Types of IRAs that support cryptocurrency investing

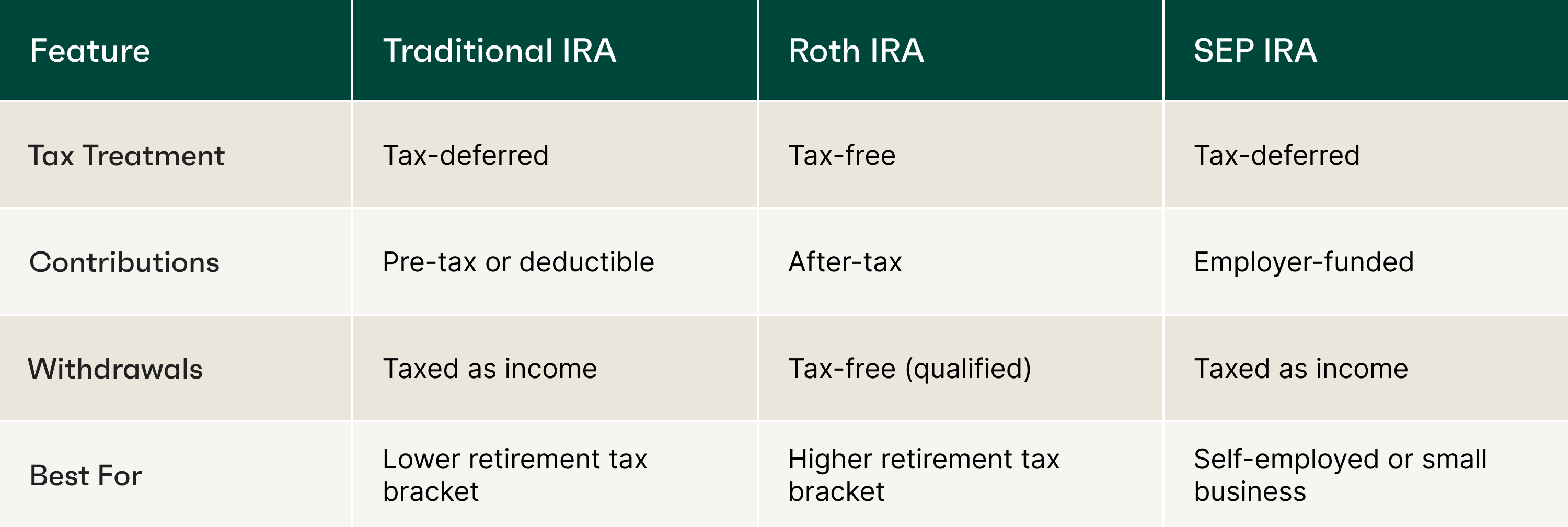

To buy crypto in an IRA, you can choose from three self-directed structures:

This choice should depend an investor’s:

- Current vs. expected future tax bracket.

- Income type (self-employed vs. employee).

- Risk appetite and long-term goals.

IRA structures for holding digital assets

A crypto IRA requires:

- A qualified custodian that supports digital assets.

- Integration with a cryptocurrency exchange for trading.

- Secure cold storage custody of assets.

Example: Alto CryptoIRA® partners with Coinbase, providing access to 250+ assets with a 1% trade fee.

IRS rules require:

- Investors cannot personally hold the crypto.

- All transactions must go through the custodian.

- Assets must stay inside the IRA until eligible withdrawal.

Regulations and rules for buying crypto in an IRA

To stay compliant, investors must follow these rules:

- Fund the account with cash only (cannot transfer existing crypto).

- Avoid prohibited transactions, like an investor buying crypto from themselves.

- All income and growth must remain in the IRA.

- Withdrawals before age 59½ may face penalties (unless qualified exceptions apply).

Breaking rules can lead to immediate taxes and penalties, potentially disqualifying the IRA.

Eligible cryptocurrencies and investment restrictions

The IRS does not specify which coins are allowed. Each custodian decides the supported list.

Most platforms include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Other established assets

Restricted assets:

- Collectibles such as art-based NFTs

- Illiquid, high-risk tokens not recognized by the custodian

Weighing the benefits and risks of crypto IRA investing

Benefits

- No capital gains tax inside the IRA

- Tax-deferred or tax-free growth

- Potentially high returns from crypto’s upside

- Greater diversification

Risks

- Volatility can cause significant/total losses

- Lack of FDIC/SIPC insurance

- Regulatory uncertainty in the crypto sector

- Security risks like hacking

Potential tax advantages and growth opportunities

This is one of the strongest cases for using an IRA structure for crypto investing.

Market volatility, regulatory uncertainties and security concerns

When buying crypto in an IRA, investors must prepare for:

- Price swings: Crypto can gain or lose double-digit percentages in days.

- Regulation: New laws may restrict how crypto is taxed or held.

- Security: Unlike traditional deposits, crypto isn’t insured.

Look for custodians with:

- Cold storage custody

- Multi-signature wallets

- Strong compliance standards

Steps to purchase cryptocurrency in an IRA

Here’s how to buy crypto in IRA accounts step by step:

- Select a custodian specializing in crypto IRAs.

- Fund the account via annual contribution, rollover or transfer.

- Trade crypto through the platform’s exchange integration.

Selecting a compliant custodian or platform

Evaluate providers based on:

- Licensing & compliance (trust company, regulated entity)

- Security measures (cold storage, multi-sig, insurance on USD balances)

- Fee structure (setup, annual, per-trade)

- Cryptocurrency selection

Alto’s CryptoIRA®, for example, offers the following:

- 1% flat trade fee

- No annual account fee

- 250+ supported assets

Funding the IRA, contributions, rollovers and transfers

Ways to fund a crypto IRA:

- Annual Contributions: Add new cash (up to IRS limit).

- IRA Transfers: Move funds from another IRA.

- 401(k) Rollovers: Bring funds from a workplace retirement plan.

Important: Investors cannot move crypto they already own. Only cash contributions are allowed.

Placing orders and managing crypto assets inside the account

Managing a crypto IRA includes:

- Placing trades: Buy/sell via the custodian’s platform or app.

- Monitoring: Check asset performance regularly.

- Understanding fees: Most charge about 1% per trade.

- Rebalancing: Adjust holdings to align with long-term goals.

Conclusion

Buying crypto in an IRA can unlock unique opportunities:

- Tax-advantaged growth

- Diversification benefits

- Potential long-term upside

At the same time, investors should consider:

- Volatility risks

- Regulatory changes

- Custodial security

By choosing the right IRA type, compliant custodian and smart strategy, investors can confidently add cryptocurrency to their retirement portfolio.

Frequently Asked Questions

Can investors buy Bitcoin and Ethereum within an IRA?

Yes. Most crypto IRA platforms support leading coins like Bitcoin and Ethereum.

What fees apply when buying crypto through an IRA platform?

Typically: setup fee, annual fee and trading fee (about 1%). Some providers, like Alto CryptoIRA®, simplify with only a trading fee.

How are taxes handled for crypto transactions in IRAs?

There are no capital gains tax on trades. Traditional/SEP IRAs are taxed at withdrawal; Roth IRAs offer tax-free withdrawals if qualified.

What happens to staking rewards earned inside a crypto IRA—are they taxed right away?

No. Staking rewards earned inside a crypto IRA are treated like other investment gains:

- In a Traditional or SEP IRA, taxes are deferred until withdrawal.

- In a Roth IRA, rewards can be withdrawn tax-free in retirement (if qualified).

- Rewards must stay inside the IRA to maintain tax advantages.