InvestX Fund V: AI & Robotics seeks to deliver capital appreciation by investing in late-stage private companies with strong growth potential and clear paths to liquidity.

InvestX Fund V targets 10-12 portfolio holdings across Artificial Intelligence and Robotics & Automation, aiming to provide investors with distributions following liquidity events while maintaining prudent portfolio construction and alignment with long-term value creation.

Offering Details

Upcoming Webinar

Register here

Additional offering details

Maximum Fund Raise: US $150M

About InvestX

Launched in 2014, InvestX is an asset manager providing late-stage venture funds to investors and the wealth management industry, backed by leading financial institutions including Jefferies, Virtu Financial, and Canaccord Genuity. InvestX has invested over $675 million in growth and late-stage companies since 2015.

Investment opportunity

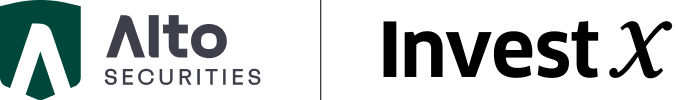

AI is a defining technology of the 21st century, with over $1.3T in AI revenue1 and spending projected by 2029 and ~81% of U.S. GDP growth in Q1 2025 attributed to AI.

AI spend and revenue are projected to contribute significantly to future growth

Humanoid and automation technologies could reshape the $24T global labor market, driving efficiency gains, addressing labor shortages, and strengthening supply chains.

AI investment opportunities remain concentrated in private markets with:

As AI adoption accelerates at unprecedented speed, investor exposure to leading private-market innovators becomes increasingly important.

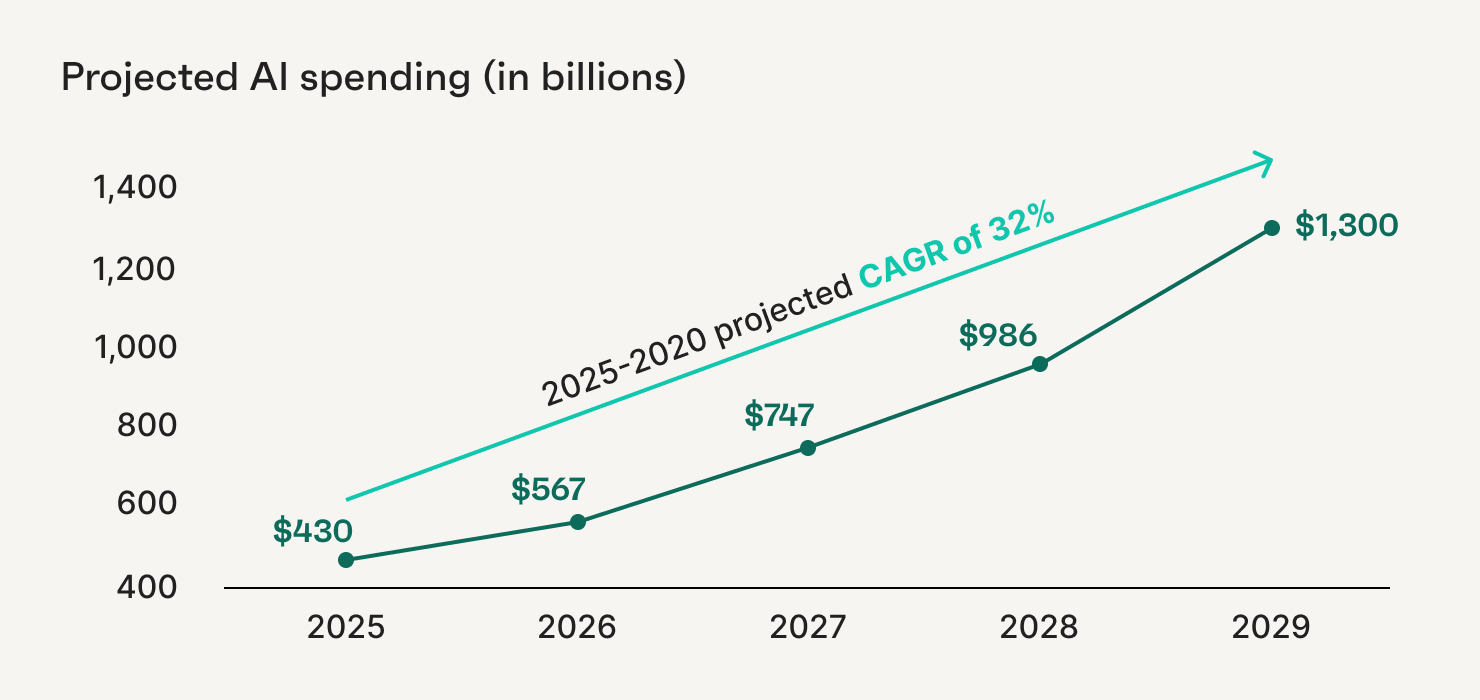

Initial investments in Fund V

Fund V is constructing a focused portfolio, with initial investments made in companies that reflect its AI and robotics strategy.

Investment thesis

Fund V invests across two themes:

Artificial Intelligence (AI): Companies developing algorithms, platforms, and foundational technologies that enable intelligent decision-making, automation, and the AI ecosystem. Focus areas include machine learning, NLP, semiconductors, sensors, machine vision, high-performance computing, and cloud infrastructure.

- Thesis: AI platforms and infrastructure scale rapidly, benefit from network effects, and unlock new efficiencies across industries; companies owning critical intellectual property with defensible moats provide essential infrastructure for the growing AI economy.

Robotics & Automation: Companies designing and deploying robotic systems and automation solutions across industries.

- Thesis: Robotics reduces costs, disrupts traditional workflows, and addresses labor shortages.

Fund V uses a disciplined investment process targeting companies with valuation scale, growth velocity, path to profitability, market leadership, and potential liquidity events, supported by InvestX’s investment committee and research model.

Note: InvestX evaluates a prospective portfolio company based on its prior performance according to the 5-Factor Model. The fact that a company has performed well historically according to the 5-Factor Model does not guarantee or indicate that such performance will continue, or that the SPV's investment in such company will be profitable.

AI and robotics focus

LLMs and infrastructure: Fund V will build a selective core position in LLMs and infrastructure.

Vertical opportunities: As verticals mature, we believe select companies can gain strong traction in AI deployment at the application and robotics layer. Holdings in this phase will be characterized by:

- Deep domain expertise

- Proprietary data or models

- Custom software enabling seamless workflows

- Significant labor efficiency and productivity gains

- Defensible moats against larger LLMs

Note: Investment committee process does not guarantee performance. While the Fund Group will target Portfolio Companies that meet the Investment Criteria, there is no guarantee that securities of such Portfolio Companies will be available to the Fund Group once identified. The Fund Group may invest in Portfolio Companies that do not meet the Investment Criteria. This example companies are shown for informational purposes only. The Fund may or may not invest in any or all of these companies.

About the investment team

The team is led by experienced private-market investors with deep AI and venture expertise:

Marcus A. New, Founder & CEO

Led 60+ growth equity investments; former CEO of Stockhouse.

Don Short, CFA, Head of Venture Equity

Former CIO and Director at Qwest Investment Fund Management; Equity Analyst at Raymond James.

Dan Sanders, EVP, Private Markets

Previously Head of Execution Services for Citi and Head of Business Development for Liquidnet.

Argenys R. Morban, Senior Associate

Former Goldman Sachs (Software coverage); BA Economics & Statistics.

The InvestX Edge

Information access: Obtaining company information during funding rounds can be extremely difficult, and InvestX’s approach provides enhanced access to the insights required to evaluate late-stage private opportunities.

Experienced investors in AI: InvestX has a deep understanding of the AI ecosystem and has invested in many of the top AI companies over the past three years, leveraging disciplined research and sector expertise.

Secondary markets: InvestX operates a proprietary OTC desk that trades blocks of private shares on the secondary market, serving clients that include three of the top five global sell-side firms and other leading institutions. Please note that where investments are made through a third party fund manager, Investx will have more limited access to information.

Risks

Note: This is not an exhaustive list of risks. Please refer to the offering documents for a comprehensive understanding of risks associated with this investment.

Offering Documents

Please log in or sign up to view additional Investment Documents for this offering. Additionally, you can email investorrelations@altoira.com to schedule an appointment for more information.

- MishTalk, total GDP growth Q1 2025 1.36%, AI contribution 1.1%.

- Pitchbook, September 2025.